Read an update from our CIO on market volatility

here.

Our products and services

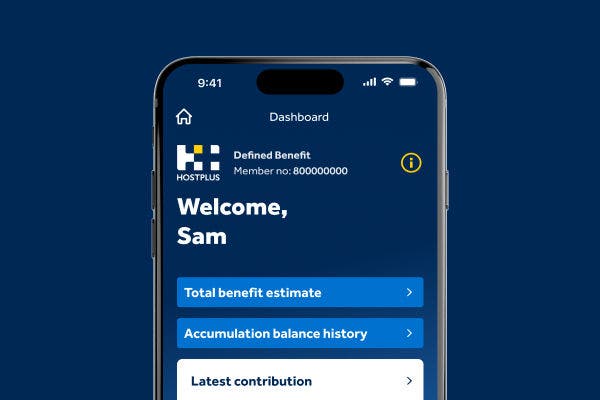

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Learning Hub

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Manage your super

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Retirement

Retirement Forum - optimise your retirement potential and stay informed

Join us at our Retirement Forum event on Tuesday April 29 – designed specifically for members in retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Your responsibilities

How to make payments

Tools and resources

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

- Home

- Members

- Our products and services

- Your investment options

- Compare investment options

- Conservative Balanced

Conservative

Balanced

The Conservative Balanced investment option is focused on delivering the best net return from investing in a portfolio that has a similar proportion of growth and defensive assets and has high diversification.

At a glance (Accumulation)

Awards and ratings are only one factor to be taken into account when choosing a super fund.

Click here for important information about Lonsec Research Ratings.

* Investment costs are based on estimated and actual information from the previous financial year. The costs payable in future years may be higher or lower. Administration and other fees also apply. For a full breakdown of fees and costs, see our fees and costs page or Section 6 of the Member Guide.

^ Investment return over 10 years to 31 March 2025, net of investment fees and costs. Administration and other costs apply. Returns won’t display for options younger than 10 years. See the investment returns page for returns over all available periods.

Who is Conservative Balanced suitable for?

With a similar proportion of growth and defensive assets, this Core pre-mixed investment option is designed for members with a medium to long-term investment timeframe, who are seeking moderate long-term returns and have a medium tolerance of negative returns.

Read our Member Guide for more information about these terms.

Our target

asset mix

| Asset class | Target | Range |

|---|---|---|

| Australian shares | 16% | 10–30% |

| International shares (developed markets) | 17% | 10–30% |

| International shares (emerging markets) | 5% | 0–15% |

| Property | 9% | 0–25% |

| Infrastructure | 9% | 0–25% |

| Private equity | 3% | 0–10% |

| Credit | 7% | 0–20% |

| Alternatives | 6% | 0–20% |

| Diversified fixed interest | 18% | 10–40% |

| Cash | 10% | 5–25% |

Head to Member Online to choose the investment option that’s right for you.

Past

performance

Accumulation

This table shows the 12-month net return for our Conservative Balanced option at 30 June each year. The net return is the money the investment has earned, minus investment costs and taxes.1

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Return | -0.07% | 14.19% | -2.10% | 7.49% | 6.67% |

This table shows the average net return for our Conservative Balanced option over 3, 5 and 10 years to 30 June 2024.1

| Year | 3 years | 5 years | 10 years |

|---|---|---|---|

| Average return (p.a.) | 3.92% | 5.07% | 6.23% |

1. Administration and other fees also apply. For a full breakdown of fees and costs, see our fees and costs page or Section 6 of the Member Guide. Past performance is not a reliable indicator of future performance and should never be the sole factor considered when selecting a superannuation fund.

Ready to join? Online applications only take five minutes.

Or call us on 1300 467 875

8am – 8pm (AEST/AEDT), Monday to Friday.