Our approach to investing is driven by our strong, diverse and proven investment beliefs. We’re not afraid to be different to other investment managers and super funds. That’s why our investment portfolio looks different – and performs well.

- They should be well-diversified to produce returns and reduce risk.

- They should provide a healthy income stream from a range of sources to support returns, given our expectations for low capital growth across asset classes going forward.

- They should focus on active management, because in a low-return world, any additional returns that can be generated by actively selecting assets and managing risk will be highly valuable.

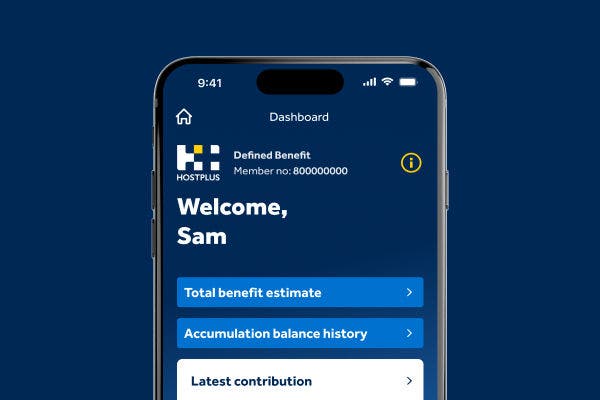

- Each of our six investment options follows its own distinct investment strategy and is designed to help your clients achieve a certain investment objective for the level of risk they prefer.