If you’ve got a new family member on the way, you may want to make sure your insurance still meets your needs.

Read an update from our CIO on market volatility

here.

Our products and services

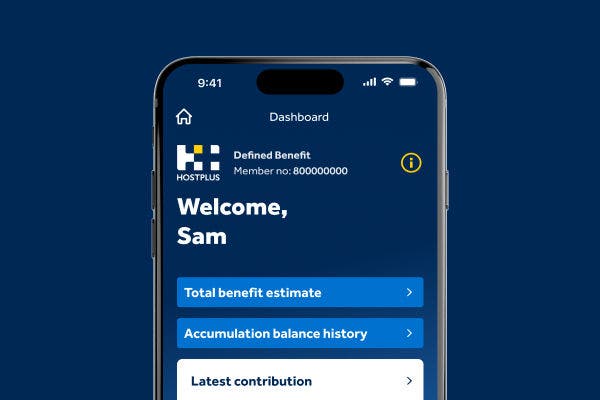

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Learning Hub

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Manage your super

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Retirement

Retirement Forum - optimise your retirement potential and stay informed

Join us at our Retirement Forum event on Tuesday April 29 – designed specifically for members in retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Your responsibilities

How to make payments

Tools and resources

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

- Home

- Members

- Manage your super

- Life changes

- Starting a family

Starting

a family

Everything changes when you have children. And while your super may not be your top concern now, taking parental leave – or any other form of career break for that matter – can have an impact on your future super balance. Let’s take a look at the options that can help you enjoy a positive future down the track.

Every contribution

is a plus

From spouse contributions to the government’s co-contribution scheme, there are a number of ways to boost your super if you take a break from work.

Contribution splitting

Your partner can opt to split up to 85% of their eligible super contributions and deposit those funds into your account. This could help you continue growing your balance and maintain any insurances associated with your account.

You can’t be at preservation age or permanently retired, and you can only split the contribution as a lump sum immediately after the end of the financial year.

Make spouse super contributions

Your spouse can also make after-tax contributions to your super and may be able to receive the maximum 18% tax offset – which means they’ll be up to $540 better off if you earn $37,000 per annum or less. While it may not be as effective from a tax point of view as contribution splitting, it still helps to grow your super balance, so you can enjoy retirement together.

It’s easy to make voluntary contributions to your super. Simply log in to Member Online or the Hostplus app to find the BPAY details for your account.

Take advantage of government super co-contributions

The government’s super co-contribution scheme is designed to help low-to-middle-income earners increase their super contributions. You need to pass the income threshold test and make after-tax contributions to your super, but you could see an additional amount of up to $500 hit your super account at tax time if you’re eligible.

Consolidate your super accounts

If you have multiple super accounts, merging these into one single Hostplus account when you go on parental leave could offer lots of positives – like saving money on unnecessary fees and other costs (such as insurance premiums). Plus, because it’s all in one place, you’ll be able to manage and track your investments more easily.

Before you consolidate1, there’s a lot to consider. Always do your own research or seek financial advice to make sure it’s right for you.

1. Before consolidating your super, you should check with your existing super fund on whether there are any fees or charges that may apply or any loss of benefits, such as insurance cover. If you have insurance cover with another super fund, you may be able to transfer that cover to Hostplus. To find out if you are eligible visit hostplus.com.au/insurance to learn more. You may also find it beneficial to obtain advice from a licensed financial adviser.

Get peace of mind for

you and your growing family

Find the right insurance for your situation

Find information and resources to help you get the right cover, transfer insurance to Hostplus or nominate a beneficiary.

Apply for premium-free cover while on parental leave

You might be eligible for premium-free insurance cover during your parental leave.

Log in to get your super and insurance ready for your new arrival.

Get expert financial advice

If you’re starting a family, the right advice could be priceless. Expert financial advice can help you:

- understand how you can continue to grow your

super balance while on parental leave - get the right insurance for your situation

- maximise government benefits

- develop an estate plan in case the worst should

happen.

Whatever your needs, we have a range of expert advice options to help you create a positive financial future.