Our products and services

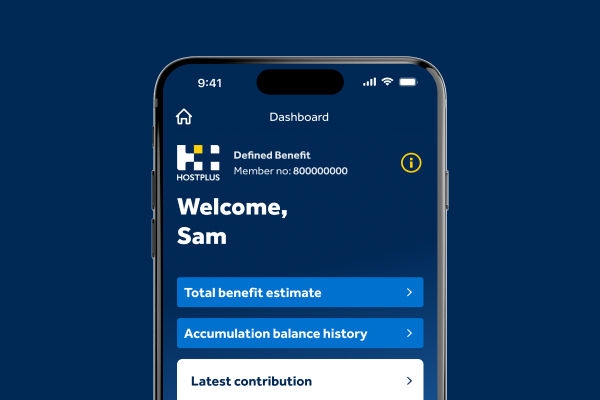

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Learning Hub

Try SuperSmart today

An interactive way to get financial education and tailored advice* online to help supercharge your future.

Exclusive to Hostplus members 24/7 via Member Online at no extra cost.

*Members with Term Allocated Pension, Lifetime Pension, Defined Benefit Pension, nil balances, non-standard investment options and some Maritime Contributory Accumulation members cannot access SuperSmart financial advice services.

Manage your super

Try SuperSmart today

An interactive way to get financial education and tailored advice* online to help supercharge your future.

Exclusive to Hostplus members 24/7 via Member Online at no extra cost.

*Members with Term Allocated Pension, Lifetime Pension, Defined Benefit Pension, nil balances, non-standard investment options and some Maritime Contributory Accumulation members cannot access SuperSmart financial advice services.

Retirement

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Your responsibilities

How to make payments

Tools and resources

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

- Home

- Members

- Manage your super

- Grow and manage your super

- Find your lost super

Find your

lost super

Imagine finding a stash of money that you didn’t even know was yours. And then imagine what that could mean for your future. Discover how to track down lost super and use it to boost your retirement funds.

Billions of $ in lost super.

Is some of it yours?

If you’ve switched jobs, forgotten to update your account details, or changed your name or address, you may have unclaimed super waiting to be found. But where’s it hiding?

Australian Taxation Office (ATO)

Super providers must pay any inactive low-balance accounts to the ATO, who will hold the funds for you. An account is deemed to be ‘inactive’ if:

- it has not received any super for 16 months

- it has a balance of less than $6,000

- it has no insurance attached, and

- you have not met a prescribed condition of release.

Super provider

If you have multiple super funds and neither account is ‘inactive’, you could be paying multiple sets of fees and other charges (such as insurance premiums) – which, in turn, may mean less money for your future.

By consolidating your lost super into your Hostplus account, you could save money on fees and give your balance a welcome boost.

There’s a lot to consider when thinking about whether consolidation is right for you.1 Follow the link below for more information.

1. Before consolidating your super, you should check with your existing super fund on whether there are any fees or charges that may apply or any loss of benefits, such as insurance cover. If you have insurance cover with another super fund, you may be able to transfer that cover to Hostplus. To find out if you are eligible visit hostplus.com.au/insurance to learn more. You may also find it beneficial to obtain advice from a licensed financial adviser.

Track down your lost super

Every bit of super helps you achieve a better lifestyle in retirement. You may have $100 or $10,000 in super sitting with the ATO or another super fund – but it all adds up. Not sure if you do? It never hurts to spend 10 minutes to check.

The ATO has made it easy for you to find any lost super. Here’s how.

Visit myGov

Go to myGov. Log in or create a myGov account, then link your myGov account to the ATO.

Find your super

Select ‘super’ from the menu in your ATO account. This will allow you to see all your super accounts, including any that you’ve forgotten about, as well as any

ATO-held super.

Transfer

Consolidate your super into your Hostplus account.1

1. Before consolidating your super, you should check with your existing super fund on whether there are any fees or charges that may apply or any loss of benefits, such as insurance cover. If you have insurance cover with another super fund, you may be able to transfer that cover to Hostplus. To find out if you are eligible visit hostplus.com.au/insurance to learn more. You may also find it beneficial to obtain advice from a licensed financial adviser.

Ready to consolidate your super?

If you decide to consolidate, get started by logging into Member Online and entering the details of your other super accounts.

Alternatively, you can call our customer service centre on 1300 467 875 and our team can help you consider the options available to you.

Boost your balance with voluntary contributions

Finding lost super isn’t the only way to maximise your retirement funds. Increase your super balance by making additional payments above and beyond your employer’s compulsory contributions – you’ll be surprised how even small amounts can make a big difference over time.

Get the right advice for your situation

Getting the right financial advice now can help set up your future. At Hostplus, we offer a range of advice options to help you make the most of any lost super, from our Super Adviser digital tool to face-to-face sessions with our financial planners.