Read an update from our CIO on market volatility

here.

Our products and services

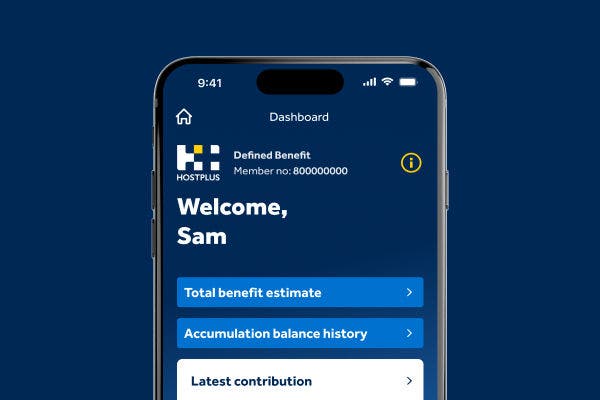

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Learning Hub

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Manage your super

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Retirement

Retirement Forum - optimise your retirement potential and stay informed

Join us at our Retirement Forum event on Tuesday April 29 – designed specifically for members in retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Your responsibilities

How to make payments

Tools and resources

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

- Home

- Members

- Manage your super

- Life changes

- Changing jobs

Changing

jobs

Changing jobs can give you a fresh start, boost your career and provide you with new and exciting opportunities. We’ve provided everything you need to move your Hostplus account to your new employer.

'Stapling' and your super account

Federal government legislation introduced in 2021 means that your super fund is now ‘stapled’ to you – that is, in most cases your super account automatically moves with you when you change jobs. So, unless you choose to change super funds, your super will stay with the one fund throughout your working life.

The good news? It's one less admin task when you change jobs. Your new employer will check whether you have an existing fund and will pay your super contributions into that fund. You don’t need to do a thing.

Take us

with you

If you do need to provide your new employer with information about your super fund, we make it easy.

Get your pre-filled fund nomination form

Simply log in to Member Online or use the Hostplus app to download your pre-filled fund nomination form to give to your employer.

Download a blank fund nomination form

If you prefer, you can download a blank form to fill in yourself. You'll need to send this to your employer, along with a letter of compliance.

Fill out a compliance letter

You may need to give your employer a letter of compliance to ensure your super continues to be paid to Hostplus.

Consolidate your super accounts

If you have multiple super accounts, a new job is a great opportunity to merge them into one single Hostplus account. With all your super in one place, you’ll be able to manage and track your investments more easily. Plus, you may save money on unnecessary fees and other charges.

There's a lot to consider when thinking about whether consolidation is right for you.1 Follow the link below for more information.

1. Before consolidating your super, you should check with your existing super fund on whether there are any fees or charges that may apply or any loss of benefits, such as insurance cover. If you have insurance cover with another super fund, you may be able to transfer that cover to Hostplus. To find out if you are eligible, visit Transfer your cover to Hostplus. You may also find it beneficial to obtain advice from a licensed financial adviser.

Let’s build your future together. Log in to send your super details to your new employer.

Need

to know

The following information may help you set up your super with your new employer faster.

Hostplus Australian Business Number (ABN)

68 657 495 890

Unique Superannuation Identifier (USI) & Super Product Identifier Number (SPIN)

HOS0100AU

Fund address

Locked Bag 5046, Parramatta, NSW 2124

There are lots of positives

about choosing Hostplus

Compare superannuation funds

We’re proud that Australians across all industries choose us as their super fund. Review us against our competitors to see how we compare with other funds.

Our performance

Our investment options are competitive and innovative. Check our performance to see how we’ve delivered strong long-term returns to our members.2

2. Past performance is not a reliable indicator of future performance and should never be the sole factor considered when selecting a superannuation fund.

How we invest

Every single day, we have our members’ best interests at heart – and that means investing their money responsibly for long-term growth and strong returns. Discover the key principles that guide our investment approach.