Read an update from our CIO on market volatility

here.

Our products and services

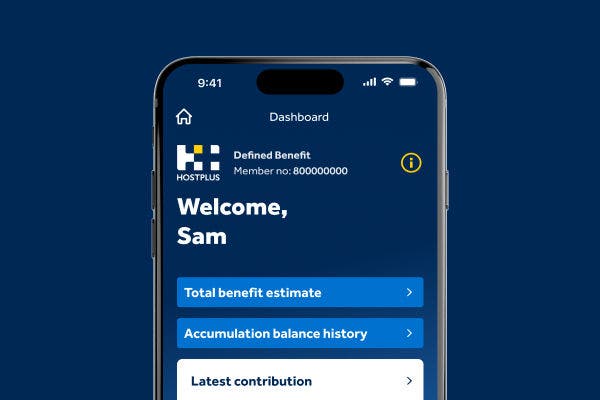

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Learning Hub

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Manage your super

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Retirement

Retirement Forum - optimise your retirement potential and stay informed

Join us at our Retirement Forum event on Tuesday April 29 – designed specifically for members in retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Your responsibilities

How to make payments

Tools and resources

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Products,

Fees and

Performance

Like you, we want to help your clients build a positive financial future – and our products, fees and investment approach all aim to support that goal.

Our fees and costs

We know that fees and costs are an important consideration when it comes to selecting a super fund or pension. That’s why we’re transparent about our fees and aim to keep our costs as low as possible, while still aiming to provide strong investment returns. After all, it’s the net benefit – the amount that hits your clients’ accounts after all fees, costs and taxes have been paid – that’s key. We work hard to maximise net benefit for members, so they can enjoy their best possible retirement.

Join an award winning team

Our measure of success is what we deliver for our members. But if you're into awards, we've got those too.

Products we offer

Wherever your clients are on their financial journey, we can help.

Accumulation products

A low admin fee and strong long-term performance1 can help build your clients’ retirement funds, while our range of investment options means there are options for a variety of needs and risk appetites.

Insurance

Our insurance can provide your clients with a safety net in case the unexpected happens. Premiums can be automatically deducted from your clients’ super balance, and our flexible options allow you to tailor the cover to suit individual needs. In some instances, automatic default cover may be available.

Retirement accounts

There are two types of Hostplus retirement accounts: Hostplus Pension and Hostplus Transition to Retirement. With flexible payment options and a wide range of investment options – including our innovative CPIplus option – there’s likely to be a product to support your clients’ retirement goals.

Self-Managed Invest (SMI)

Hostplus SMI makes it easy for your SMSF clients to build a diversified portfolio to support their retirement – including unique infrastructure, property and private equity investments that aren’t usually available to retail and SMSF investors.

Choiceplus

If your clients are looking to be more actively involved in managing their accumulation or retirement account, ChoicePlus could be the answer. With many of the benefits of a self-managed super fund (SMSF) – but less admin and lower costs – ChoicePlus puts investment decisions directly in your clients’ hands.

CPIplus

If your clients are looking for a pension investment option that offers protection from share market risk while providing flexibility and consistent long-term returns, CPIplus might be the right option. It’s suitable for those with an investment time frame of more than two years.

We’re here to help you give your clients the future they deserve

Our performance

We measure our success by what we deliver for our members, like our award-winning2 and consistently strong returns.1

Investment returns at your fingertips

We offer daily unit pricing rather than weekly crediting rates, giving you oversight of performance and making it easier to switch investment options. It’s another way we’re giving your clients greater control over their future.

Ready to register with Hostplus?

Your first step is to complete the online Adviser Registration form.

Need more help? Call us on 1300 467 875 (choose option 4) and we’ll answer any questions you might have.

1. Past performance is not a reliable indicator of future performance and should never be the sole factor considered when selecting a superannuation fund.

2. Awards and ratings are only one factor to be taken into account when choosing a super fund.