Your super is likely to be one of the biggest assets you’ll own, but many people struggle to understand how to get the most out of it to create financial security in retirement. A Hostplus financial planner explains the key features of super that could help you save for your retirement.

Read an update from our CIO on market volatility

here.

Our products and services

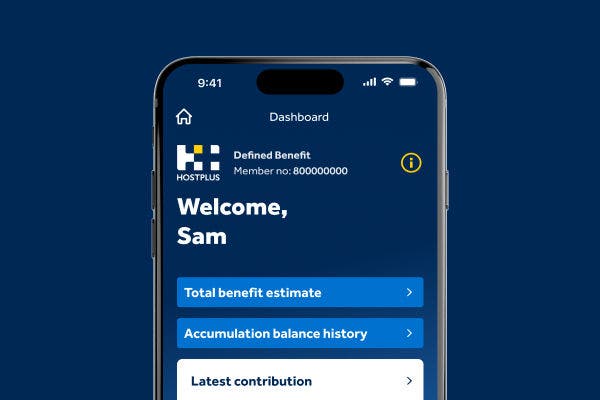

It’s easy on the Hostplus app

Defined benefit members are now welcome to download our mobile app and try out a range of helpful features. View total benefit estimates, monitor investments, check insurance and more.

Learning Hub

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Manage your super

Retire Ready - prepare for a secure and fulfilling retirement

Join us at our Retire Ready event on Tuesday April 29 – designed specifically for members nearing retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Retirement

Retirement Forum - optimise your retirement potential and stay informed

Join us at our Retirement Forum event on Tuesday April 29 – designed specifically for members in retirement.

Consider the relevant PDS and TMD available at hostplus.com.au before making a decision about Hostplus. Issued by Host-Plus Pty Limited ABN 79 008 634 704 as trustee for the Hostplus Superannuation Fund ABN 68 657 495 890

Forms and resources

Our notice of intent to claim a tax deduction (NOITC) service is available online

Simply log in to Member Online, navigate to ‘Super’ in the top menu, and select

‘Claim a tax deduction’.

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Your responsibilities

How to make payments

Tools and resources

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Why Hostplus

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

Product and fee information for advisers

Retired and looking for more certainty over your returns?

Introducing CPIplus, a Pension investment option that aims to deliver a consistent and predetermined return above inflation each year.

Not available for Transition to Retirement Pensions. Though returns above inflation are predetermined annually, Hostplus can shorten the return period. Hostplus may also adjust the rate of return with at least 30 days’ notice.

News and insights

Investment options

Pricing and performance

Tools and resources

News & insights

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

Our company

Careers

-

Member Online

Enter your Member Number and Password to access your account anytime.

-

Pension Online

Log in to manage your Pension account 24 hours a day, 7 days a week.

-

QuickSuper

Pay your employees super contributions across multiple super funds.

-

Self-Managed Invest (SMI) for SMSF

Enter your Username and Password to access your account and start managing your investments.

-

Member Join

Everyone is welcome to join us as a member of our personal super plans.

-

Pension Join

Starting a Hostplus Pension or joining Hostplus if you’re not already a member is easy.

-

Employer Join

No fees. Easy payments. Become a registered Hostplus employer in less than 10 minutes.

-

SMSF Join

It only takes a few minutes to register to invest with Hostplus Self-Managed Invest.

How super

works

Learn how super works

Information on super concepts if you’re new to super.

What is Super?

What is net benefit?

Net benefit is the simplest, most powerful way to measure how much value your superannuation fund offers. Hear from a Hostplus financial planner as they explain what ‘net benefit’ means and why you should care about it.

Using super to save for a home deposit

The First Home Super Saver Scheme or FHSSS, is a Federal Government initiative to help first-time home buyers buy their dream home. A Hostplus superannuation adviser explains the factors to consider when using this strategy.

Growing your

super

Learn about growing your super

Steps you can take now to make a difference to you in the future.

Choosing the right investment option

If you haven't actively chosen an investment option for your super, your money will go into what’s called a default option. Hear from a Hostplus financial planner as they talk about considerations around choosing an investment option.

How often should I review my investment options?

With your super, it’s a good idea to review your investment options at regular intervals. Hear from a Hostplus financial planner as they unpack the important things to consider when reviewing your investment options.

What to expect when you meet a financial planner?

Want to know what to expect when you meet a financial adviser? Hear from a Hostplus financial planner as they explain how the first meeting works.

Insurance in your super

Insurance protects you and your family against the unexpected. Having the right insurance in place means you’re not alone when you need help the most. Hear from a Hostplus financial planner as they unpack how to get the most out of insurance in your super.

Is consolidation right for you?

Consolidating your super may help you save on duplicated fees but it’s important to consider other factors before consolidating. Hear from a superannuation adviser as they explain what to look out for.

Women and super

Women face a significant super gap when they reach retirement age. By knowing how super works and taking small steps now, you could make a big difference to your super savings in the future. It’s never too late or too early.

Planning your

retirement

Learn how to plan and prepare for retirement

Getting ready for and managing your income in retirement.

How much money will I need in retirement?

Have you considered how much money you’ll need in retirement? There are a range of factors, including your lifestyle preferences, to consider when working it all out. Hear from a Hostplus financial planner as they cover what to consider when planning for retirement.

What are your income options in retirement?

Are you worried about running out of money in retirement? In this video, a Hostplus financial planner explains that getting financial advice could help you to maximise your income in retirement.

Learn about CPIplus

Introducing CPIplus

Watch Hostplus Financial Planner, Bahar McLeod, explain the ins and outs of CPIplus – an investment option exclusive to Hostplus Pension members.

What is CPIplus?

Hear from a Hostplus financial planner to learn about CPIplus and discover how the pension investment option aims to give you more certainty over your returns in retirement.

How does CPIplus work?

Learn from a Hostplus financial planner how the CPIplus rate is set and how it aims to deliver a consistent return above inflation each year.

How CPIplus returns compare to other investment options

In this video, a Hostplus financial planner explains how CPIplus aims to deliver an annual return that is more consistent and less volatile than growth assets like shares.

Read to get in touch?

If you’d like to speak to a qualified financial planner or arrange an appointment, please provide us with some details1 and one of our financial planners will contact you at your preferred time.

1. Hostplus is seeking to collect personal information from you so that we can arrange contact by one of the financial planners. The personal information we are seeking to collect from you is your name, postcode, date of birth, contact details, preferred date of contact, and whether you are a member of Hostplus. If you do not provide us with this information, we may not be able to carry out these instructions. The Hostplus privacy policy is available online at hostplus.com.au/privacy and includes information about how we manage your personal information, how you may access and seek correction of your personal information, as well as how you can make a complaint about a breach of your privacy.

Net investment returns represent the rate of return on investments after investment-related fees, costs and taxes have been deducted. Past performance is not a reliable indicator of future performance and should never be the sole factor considered when selecting a superannuation fund.

Awards and ratings are only one factor to be taken into account when choosing a super fund. Hostplus insurance cover is provided by MetLife Insurance Limited (MetLife) ABN 75 004 274 882, AFSL 238096.

This information is general advice only and does not take into account your needs. You should consider if this information is appropriate for you. Please read the relevant Hostplus PDS, available at hostplus.com.au before making a decision about Hostplus. For a description of the target market, please read the Target Market Determination document available at here.

Issued by Host-Plus Pty Limited ABN 79 008 634 704, AFSL 244392 as trustee for the Hostplus Superannuation Fund (the Fund) ABN 68 657 495 890, MySuper No 68 657 495 890 198.