Investing in share markets means from time to time your superannuation balance will go down instead of up.

History shows us that this volatility can spook members, prompting moves like switching super balances to less volatile options, such as cash options.

But it’s important that members use moments like these to pause and reflect on their objectives. And to remember what we’ve seen recently is a normal part of investing in assets like shares.

We’re here to help our members make informed decisions so they can maximise their retirement outcomes.

What drives share markets?

Share markets rise and fall based on many different factors. In 2022, worries about interest rates and inflation, along with the ongoing disruption due to Omicron and the Russian invasion of Ukraine, led to markets falling.

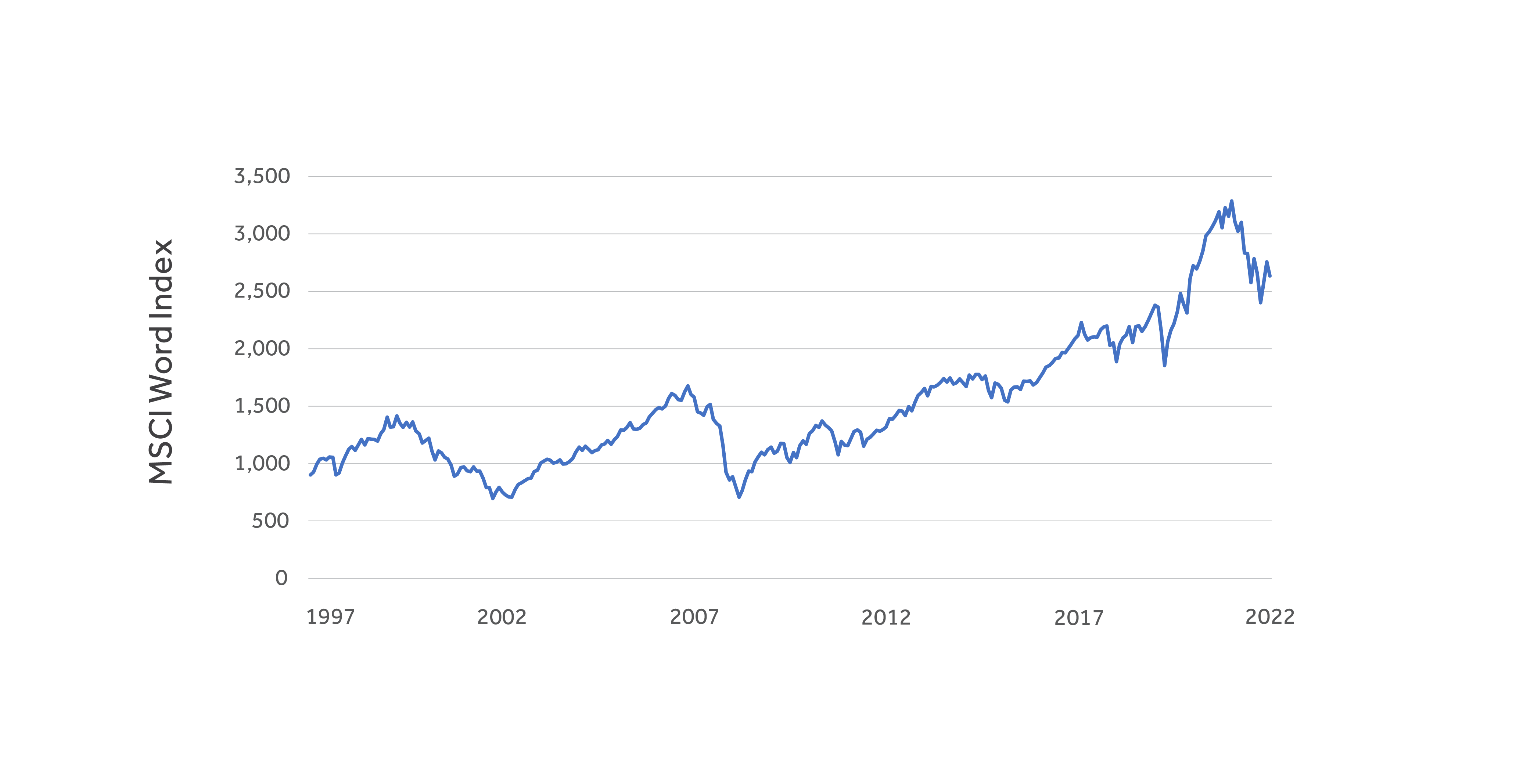

These recent falls are minor when we look at historical comparisons. Think of the global stock market crash of 1987, the tech bubble of 2000 or the global financial crisis of 2008. Those falls were much more severe, but the markets rebounded each time.

Global share markets have seen many ups and downs in the past 25 years

Source: MSCI World Index. Chart shows the aggregate performance (in US dollars) of sharemarkets in developed economies over the 25 years to 31 December 2022.

Things to consider before you switch options

So what does all this mean? Should you switch investment options in search of a better outcome?

A poll commissioned by Industry Super Australia and conducted by UMR Strategic Research in March 2022 found that a third of industry fund members have considered switching investment options in response to market swings, with members aged between 18 and 34 most likely to change.

Recent research by Iress and Griffith University also shows that out of 42,000 superannuation switch decisions made between 1 January 2019 and 31 March 2021, there was a 50% increase in “bad” switches. That is, a negative impact on super balances compared with doing nothing.

When COVID first impacted markets between February and April 2020, more than 10,000 Hostplus members switched out of our MySuper Balanced option into more defensive options like Cash, transferring more than $1 billion in total. Unfortunately, 72% of those members hadn’t switched back by the end of 2020, missing out on positive returns when the Balanced option rebounded.

If you decide to switch your investment options during a market downturn, the next decision you'll have to make is when to switch it back, which comes with its own risks. Trying to time the market can be as random as flipping a coin – getting the result you want usually comes down to luck.

Why long-term performance matters

When there's volatility in the market, often the best thing to do is nothing. Super is a long-term investment, so it's important to focus on the bigger picture of your retirement.

Our investment strategy is highly diversified and built for the long term. It has delivered excellent long-term results for Hostplus members.

It’s a strategy focused on our members' best financial interests, now and into the future.

Our leading investment returns reflect advantages of scale and stability and the importance of a robust, long-term investment strategy which aims to withstand market volatility and unexpected events, such as a pandemic.

Our default Balanced (MySuper) option is ranked the number one option over rolling 10 and 20-year periods.1 These results speak for themselves. And we’re proud to have you with us at Hostplus.

Finding the right investment option

Need help choosing an investment option? Read more on the factors you might need to consider. Or, explore our educational videos.

Hostplus offers members a range of financial advice tools to help you make appropriate investment choices. Visit our financial planning page to find the service that suits your needs.

The information in this article is correct as at time of publication.

1. Source: SuperRatings Accumulation Fund Crediting Rate Survey – SR50 Balanced (60–76) Index, September 2024. Past performance is not a reliable indicator of future performance.