Share markets rallied in the first three months of 2024, driving positive returns for Hostplus accumulation members.

Healthy economic data coming out of the US helped drive share markets up, despite inflation continuing to cause concern for investors.

Across the quarter, all Hostplus’ pre-mixed investment options delivered positive returns for accumulation members to 31 March 2024.

Listen to Con Michalakis, Deputy Chief Investment Officer, provide an update on our investment performance.

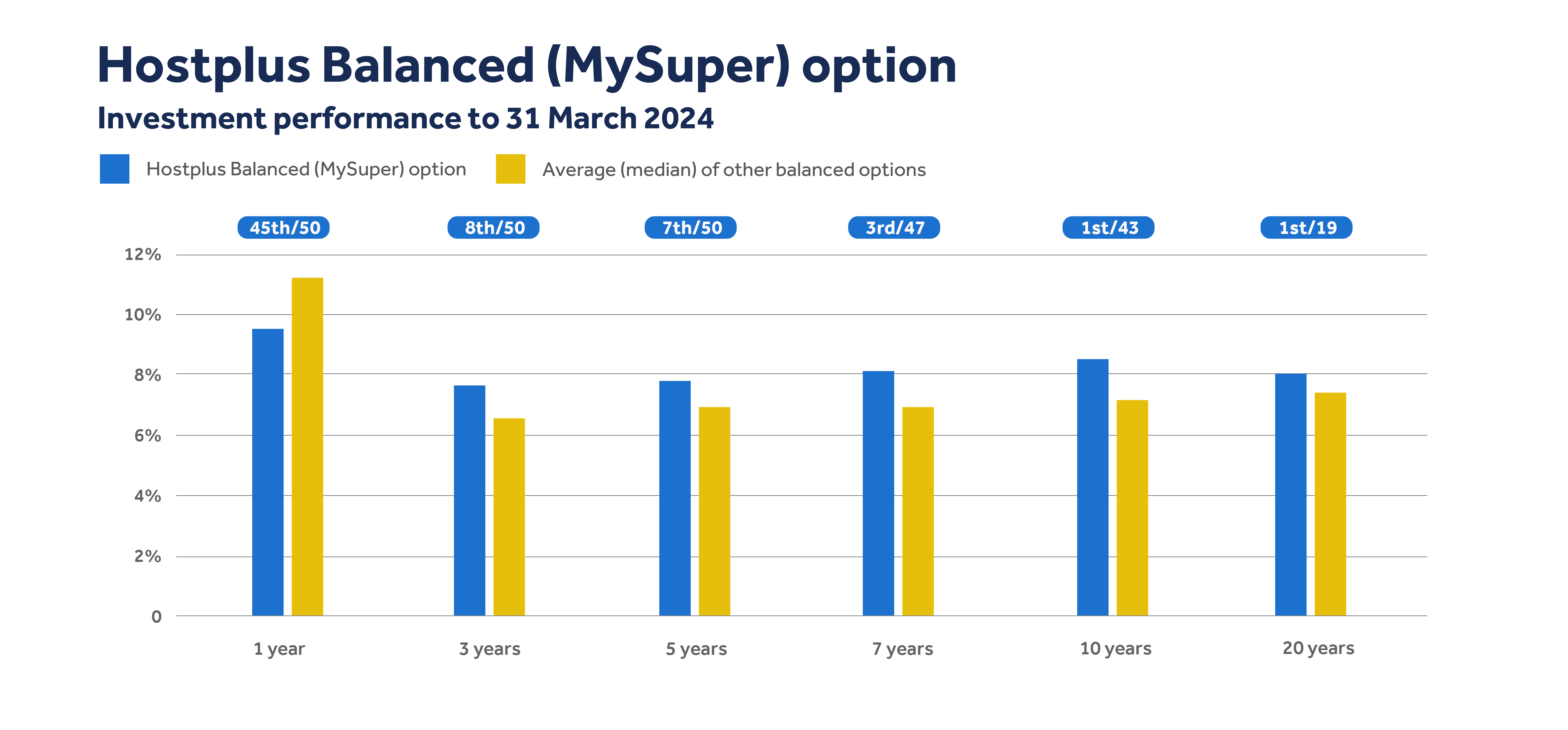

Hostplus’ Balanced (MySuper) option is still ranked number 1 over 10 and 20 years.

Our Balanced (MySuper) option, where most members invest1, returned 4.19% over the quarter.2

Super is a long-term investment. Rather than focus on what's happening over one quarter or even one year, we strive to deliver strong returns for members over 10 years, 20 years and more. The plus for Hostplus members? The Balanced option continues to perform exceptionally well over the long term, ranking the number one balanced option in Australia over 10 and 20 years, according to SuperRatings.2

These great long-term results show that our investment strategy is working hard for Hostplus members. That’s a plus.

Source: SuperRatings Fund Crediting Rate Survey - SR50 Balanced (60-76) Index, 31 March 2024. Net of investment fees and costs. Admin and other fees apply. Past performance is not a reliable indicator of future performance and should never be the sole factor considered when selecting a superannuation fund.

Get help when you need it

Our superannuation advisers can help you understand how your super is performing. If you’re a Hostplus member, you can receive personalised advice about your account at no extra cost. If you already have an adviser, they can also provide advice on your account.

Contact us on 1300 303 188, email us or book a callback today.

1. As at 31 March 2024

2. Source: SuperRatings Accumulation Fund Crediting Rate Survey – SR50 Balanced (60-76) Index, March 2024.